Octa provides an expert analysis of gold price dynamics

Gold prices renewed their all-time high last week, rising above $2,400. However, events in the Middle East at the end of the same week provoked a sell-off in the financial markets. Read the article to find out if gold will be a safe haven in times of geopolitical tensions.

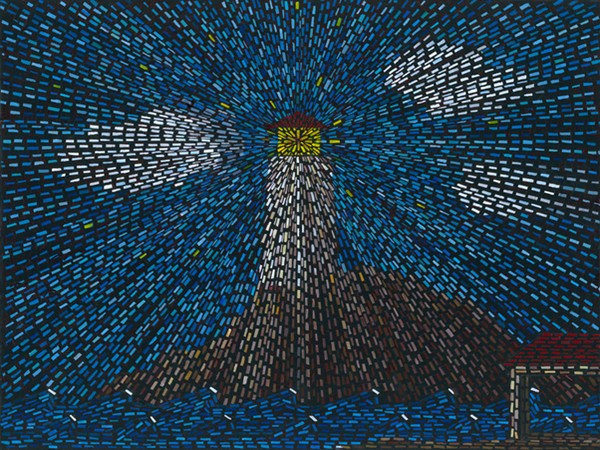

Since the beginning of the year, gold has been up more than 15%, making it the best-performing asset class since the beginning of 2024. The rise happened because of the increased demand from central banks and the fact that more investors were interested in buying physical gold through gold ETFs. Additionally, the weak U.S. dollar, which opposes gold’s value, also contributed to this increase.

However, two consecutive events interrupted the stable trend last week. A weak U.S. inflation report, followed by increasing tensions in the Middle East, caused gold to drop by over $100 in one trading session. The sudden wave of sell-offs naturally worries investors, and they wonder whether gold will continue its growth in 2024.

Weak U.S. macro data makes for a strong dollar and plays against gold’s rise

The trigger was the inflation report, which showed that prices in the U.S. are rising faster than expected. The current price growth rate at core inflation was approaching the 2% target in the middle of last year but failed to stick to that level. Towards the end of 2023, the price growth rate started picking up, reaching around 4-4.5% by April 2024, which is quite high for the U.S. This means we shouldn’t expect a rate cut anytime soon.

Here is what the Fed representatives say about it:

* ‘If inflation remains high, another rate hike may be needed altogether<…>prefer not to discuss a cut at all’, the quote from Governor Michelle W. Bowman

* ‘There is no rush to turn monetary policy around’, the quote from Susan M. Collins, president and chief executive officer (CEO) of the Federal Reserve Bank of Boston

* ‘Forecast for the start of the key rate cut is highly ambiguous, and there are no optimists’, the quote from John C. Williams, the president and CEO of the New York Fed

It is quite natural that traders have revised their views on the Federal Reserve’s early reduction of interest rates. The dollar rallied in response, posting its strongest weekly gain since 2022. A strong dollar reduces the investment appeal of gold, which is essentially on the other side of the scale.

Geopolitical tensions in the Middle East bring a nervous note

Gold dropped sharply at the end of last week as investors shifted towards riskier assets, mainly due to its strong connection with the U.S. dollar.

However, in the long term, gold will continue to be considered a safe haven for investors, especially during storms in the global political arena.

The greater the tensions, the greater the demand for the yellow metal. That’s partly why gold’s rise at this past event was subdued–the Iranian strike is estimated to have caused only limited damage to Israel, and the Israeli government has said there are no immediate plans to retaliate.

We have two vital factors at the start of the new quarter. When forecasting the price of gold, we should pay more attention to the state of the economy and the dynamics of U.S. interest rates and less attention to geopolitical conflicts, as we have already mentioned that the effect is limited.

Thus, the gold price will likely experience a downtrend, which will continue until the U.S. FOMC meeting on 12 June 2024, when the financial markets will remain Risk-on.

Octa is a global broker that has been providing online trading services since 2011, offering its clients a wide scope of tradable instruments, including gold and popular stock indices.