Empowering Financial Inclusion: IIFL Samasta Leverages Scienaptic AI for Cross-sell Program

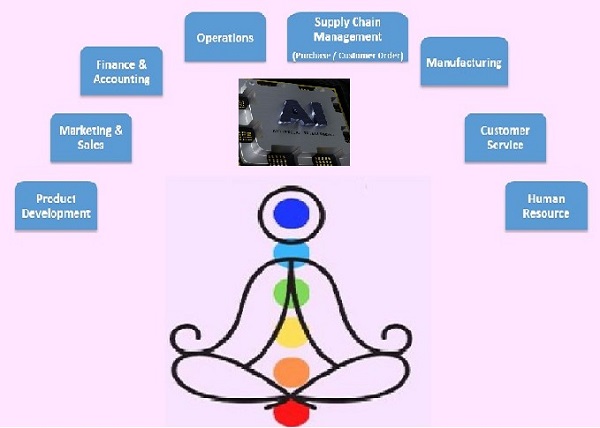

Scienaptic AI, a leading global provider of an AI-powered credit decisioning platform, announced today that IIFL Samasta will be using Scienaptic’s AI-enabled Underwriting platform to enhance their Cross-sell program to their existing MFI customer base. For each customer, the platform will run AI/ML models to instantly deliver a decision on pre-qualification, along with the loan limit and terms, via a real-time API. The Scienaptic platform provides an interactive, no-code UI interface to configure and manage underwriting journeys. The platform also has an intelligent multi-bureau connector to pull data from the required credit bureau, with the ability to dynamically shift to the secondary bureau if the primary bureau stops responding.

Samasta, a subsidiary of the large NBFC IIFL Group Company, ranks among the top five Microfinance Companies (MFIs) in India. It operates in over 22 states, servicing more than 2.7 million underbanked customers with a book size of USD 1.2 billion. Since its inception, IIFL Samasta has been committed to providing innovative and affordable financial products to unbanked sections of society in both rural and semi-urban areas.

IIFL Samasta offers a broad range of responsible financial products and services, acting as a catalyst for sustainable and inclusive economic growth. They are leveraging innovative technology solutions like Scienaptic AI to digitize their services and enhance customer experience.

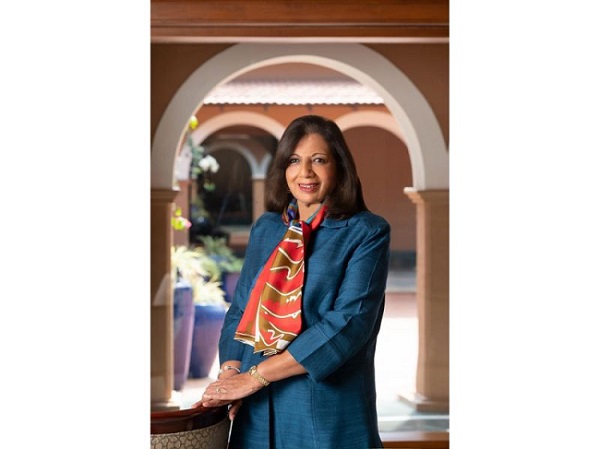

Shivaprakash D, Whole-time Director & Chief Technology Officer at IIFL Samasta, stated, “Our platform is underpinned by technology, people, and human-centered design to make credit affordable for borrowers. Scienaptic’s platform will automate the prequalification process for our existing borrower base. This will allow us to approve more prequalified offers faster, thereby helping us maximize impact and drive profitability, inclusion, and growth.”

Joydip Gupta, Head of APAC at Scienaptic, added, “We are proud to announce that IIFL Samasta, an organization making a positive impact on individuals and micro enterprises in India, has chosen our AI platform for credit decisioning. Our pre-built Pre Qualification models and self-learning AI will help IIFL Samasta underwrite loans for existing borrowers more effectively and efficiently, expanding financial inclusion across India.”

Scienaptic AI’s mission is to increase credit availability across the globe by transforming the technology used in credit decisioning. Banks, NBFCs, MFI, and fintech, use Scienaptic’s AI native credit decisioning platform to continually improve the quality and speed of their underwriting decisions.

The platform enables FIs to reach more borrowers, including underbanked and underserved individuals, and say “yes” more often without increasing risk. It democratizes automated AI-powered lending while addressing all regulatory requirements, including Fair Lending and explainable adverse actions.

Scienaptic-enabled lenders have processed more than 300 million transactions, benefitting millions of borrowers. For more information, visit https://www.scienaptic.ai