GQG Partners Increases Investment in Adani Group, Eyes Becoming One of the Largest Investors

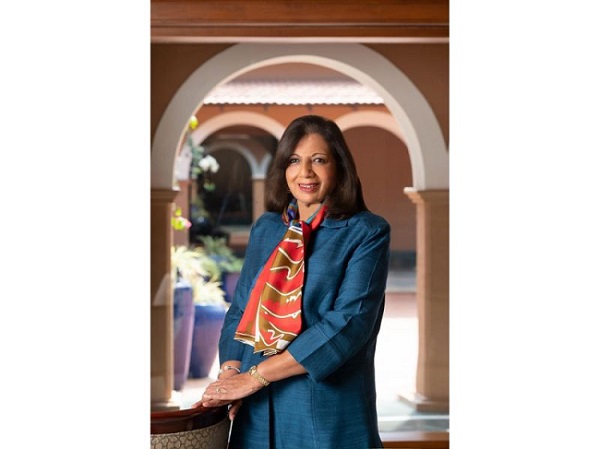

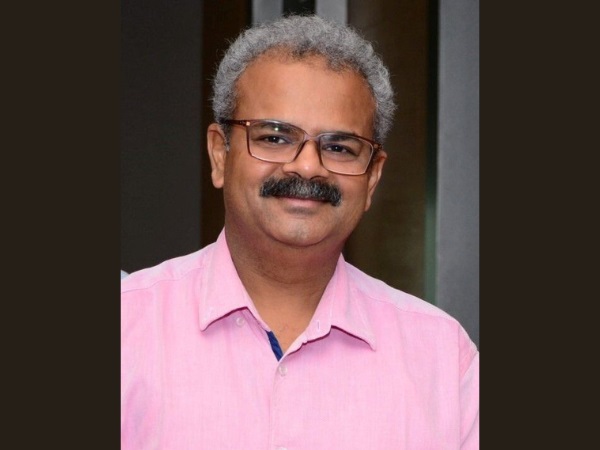

Mumbai, May 24, 2023 – GQG Partners, a prominent investment firm led by Rajiv Jain, has recently intensified its commitment to the Adani group, boosting its ownership in the diverse conglomerate spanning industries from apples-to-mining to energy. Jain praised the Adani group, stating that it possesses “the most exceptional infrastructure assets available in India.”

According to a report from Bloomberg, GQG Partners has expanded its stake in the Adani group by approximately 10%, resulting in a total investment value of $3.5 billion. However, it remains uncertain whether this increase solely represents GQG’s investment or if it incorporates gains from the surge in company stocks since their initial involvement in early March.

GQG Partners injected a substantial amount of ₹15,446 crore into the Gautam Adani-led group, spreading investments across Adani Enterprises, Adani Ports & SEZ, Adani Green, and Adani Transmission. During that time, the Adani group encountered a significant decline, with stock prices plummeting by as much as 80%. The group’s collective market capitalization also experienced a substantial drop of over 55%, amounting to ₹12.2 lakh crore, following the release of the Hindenburg report on January 24.

Expressing optimism about the Adani group, Rajiv Jain, the founder and chief investment officer of GQG Partners, aspires to become one of the “largest” investors in the group, trailing only the family in terms of valuation. Jain conveyed his interest in partnering with the Adani Group in any new ventures they undertake, aiming to accomplish this objective within the next five years.

When initially investing in March, Jain believed that the market was undervaluing Adani. As of now, GQG’s initial investment has surged to ₹24,778 crore, indicating a remarkable 60% return within 82 days. In aggregate, the Adani group’s market capitalization has escalated from ₹8.9 lakh crore to ₹12.42 lakh crore since GQG’s investment, denoting a remarkable ₹3.5 lakh crore increase or 39%.

GQG Partners’ four selected companies within the Adani group, namely Adani Enterprises, Adani Ports & SEZ, Adani Green, and Adani Transmission, have outperformed the group as a whole. The total investment figures for these companies stand at ₹15,446 crore. The average price and current market price for each company are as follows:

- Adani Enterprises: ₹5,460 crore, ₹1,400, ₹2,633.70

- Adani Ports & SEZ: ₹5,282 crore, ₹593, ₹734

- Adani Green: ₹2,806 crore, ₹501, ₹988.80

- Adani Transmission: ₹1,898 crore, ₹678, ₹868.00

GQG Partners’ strategic investments have yielded impressive results, positioning the firm as a key player in the Adani group’s growth story.

Note: This article is based on information from Bloomberg and represents the perspective of GQG Partners’ Rajiv Jain.